China’s 2026 Blueprint: Rural Revitalization Takes Center Stage 🌾

China’s 2026 No. 1 central document prioritizes rural modernization and revitalization, signaling key policy directions for agriculture and economic growth. 🌱

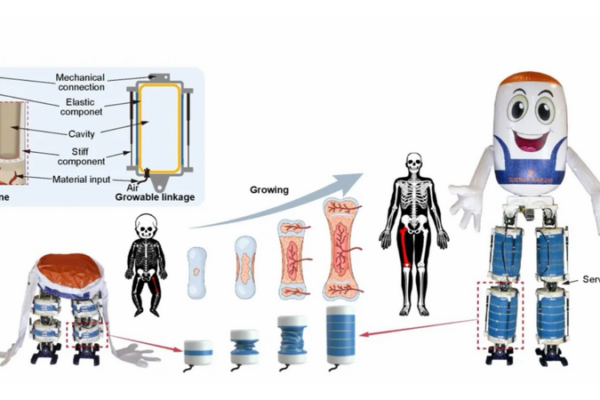

Meet GrowHR: China’s Lightweight, ‘Growable’ Robot Redefining Home Helpers 🏡🤖

Chinese researchers unveil GrowHR, a lightweight, soft robot designed for safe home assistance. With air-filled structures and unique mobility, it promises a friendlier future. 🏠🤖

China’s Tech Titans Clash in 2026 AI New Year Race 🚀🧧

Chinese tech giants Tencent, Alibaba, and others are battling for AI dominance during the 2026 Lunar New Year, offering massive incentives to shape the future of smart assistants. 🎆

Yunnan’s Cross-Border Medical Breakthroughs Save Lives 🌏⚕️

Yunnan’s cross-border medical efforts, from robotic surgeries to emergency green lanes, are transforming healthcare in Southeast Asia. Collaboration meets innovation!

China’s C919 Soars at Singapore Airshow, Challenging Boeing & Airbus Duopoly 🌏✈️

China’s C919 jet makes waves at Singapore Airshow, challenging Boeing & Airbus dominance in global aviation. ✈️🌍 #BreakingBarriers

UAE Urges Iran-U.S. Nuclear Deal to Avert Regional Crisis 🌍⚡

UAE official Anwar Gargash calls for direct Iran-U.S. nuclear negotiations to prevent regional conflict as talks resume this week in Turkey. 🌍⚖️

AI Debate Heats Up at World Laureates Summit 🌍💡

Nobel laureates and Turing Award winners debate AI’s role in science and agriculture at Dubai’s 2026 World Laureates Summit, concluding today.

OpenAI Launches Codex App to Boost AI Coding Race 🚀💻

OpenAI launches Codex desktop app to rival Anthropic’s Claude Code, offering multi-agent management and faster coding workflows in 2026’s AI race.

China Media Group Cracks Down on 2026 Winter Olympics Piracy 🏅🔒

CMG announces strict measures to protect 2026 Winter Olympics content, partnering with Migu and Beijing TV to ensure exclusive broadcasts in the Chinese mainland and Macao region.

Hong Kong Emerges as Global Mediation Hub 🌏✨

Hong Kong’s new International Organization for Mediation aims to transform global conflict resolution through dialogue-focused strategies. Exclusive insights from Secretary-General Teresa Cheng.