Historic Zhaomingtai Blends Books, Coffee & Tang Dynasty Vibes 🏯📖☕

Xiangyang’s ancient Zhaomingtai landmark now offers a mix of history, books, and coffee, blending Tang Dynasty heritage with modern culture. 🏯☕

Miao Mountain Village: Where Culture Meets Nature 🌄

Discover a Miao mountain village where ancient traditions meet modern life, offering breathtaking views and cultural wisdom in China’s highlands.

Shenzhen’s Snow Revolution: Winter Sports Heat Up the Bay Area ❄️🏙️

Shenzhen’s new snow parks and ice rinks are transforming the subtropical city into a winter sports hub, reshaping lifestyles in the Greater Bay Area. ❄️🏂 #WinterSports

China Dominates Brazil in Pre-World Cup Basketball Showdown 🏀🔥

China secures back-to-back wins against Brazil in thrilling basketball friendlies, setting the stage for FIBA World Cup qualifiers this week. 🏀🌟

China Dominates Uzbekistan, Advances to Women’s Asian Cup Quarters 🏆

China’s women’s football team secures quarterfinal spot with 3-0 victory over Uzbekistan, setting up decisive DPRK clash in AFC Asian Cup.

Milano Cortina 2026 Paralympics Kick Off with Spectacular Verona Ceremony 🌟❄️

The 2026 Winter Paralympics launched with a Shakespeare-inspired spectacle in Verona, featuring China’s largest overseas team and celebrating 50 years of adaptive sports. 🌍❄️

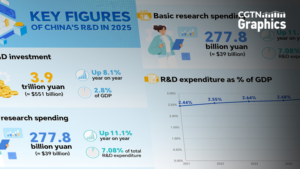

China’s R&D Surge: A Global Game-Changer? 🌍🔬

China’s 7% R&D growth target sparks global innovation opportunities, from open science projects to cross-border tech partnerships. 🌐🔍

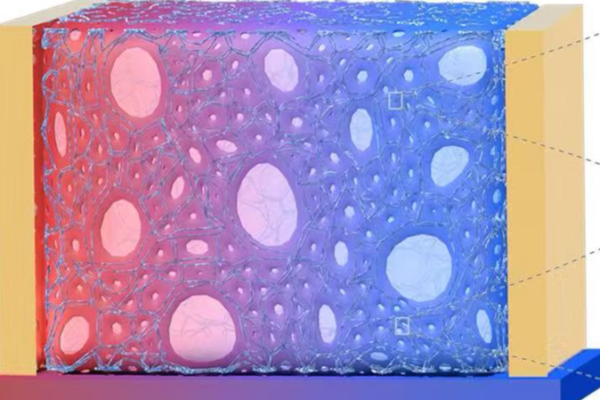

China’s Breakthrough in Wearable Energy: Flexible Material Powers Future Tech 🌟

Chinese scientists develop a flexible thermoelectric polymer with record efficiency, paving the way for self-powered wearables and IoT devices. 🌍⚡

Dubai Airport Evacuation: Explosion Sparks Chaos Amid Missile Alerts 🚨✈️

Explosion at Dubai International Airport prompts partial evacuation amid missile threat alerts. Source of blast unconfirmed; no casualties reported yet. 🚨✈️

China’s Tourism Boom: 150M Inbound Trips in 2025 🚀🌏

China welcomed 150 million international travelers in 2025, fueled by visa-free policies and mobile payment innovations. Domestic tourism also hit record highs. 🌍✈️