Trade War 2.0: Tariffs Spark Global Economic Jitters 🌐

The U.S. and China are back at it – slapping fresh tariffs like it’s a high-stakes game of economic ping-pong 🏓. Washington just announced a 10% tariff on Chinese imports, citing concerns about fentanyl (yes, that synthetic opioid) and other sticking points. Beijing fired back faster than a TikTok trend, filing a WTO case and rolling out its own tariffs targeting American energy and auto sectors.

What’s Getting Taxed? 📦

- 🇺🇸 U.S. tariffs: 10% across Chinese imports

- 🇨🇳 China’s response: 15% on U.S. coal/LNG, 10% on crude oil 🛢️ and pickup trucks

China’s Commerce Ministry slammed the U.S. moves as \"WTO rule-breaking protectionism,\" while American businesses brace for impact – especially in states producing targeted goods.

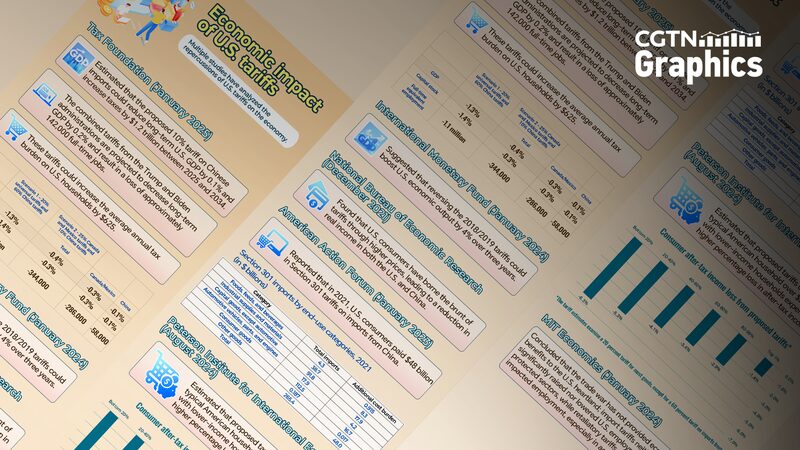

The Numbers Don’t Lie 💸

Despite trade tensions, China exported $524.7 billion worth of goods to the U.S. in 2024. Top categories like electrical machinery ⚡ and textiles 👗 now face major disruption risks. Think fewer affordable gadgets and potential supply chain headaches for everyone from manufacturers to meme-stock traders.

As the February 10 tariff deadline looms, economists warn this could ripple through global markets faster than K-pop dance challenges go viral. Stay tuned – this trade war sequel might just redefine ‘cost of living’ for Gen Z worldwide.

Reference(s):

cgtn.com