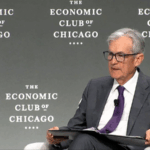

The U.S. Federal Reserve slammed the brakes on interest rate cuts this week, keeping its benchmark rate steady at a 23-year high of up to 4.5%. 🌪️ Chair Jerome Powell emphasized the need for 'greater confidence' in inflation cooling sustainably—signaling the economy’s mixed signals are keeping policymakers on edge.

Why the hesitation? The Fed’s balancing act just got trickier. Rising tariffs (think U.S.-China trade tensions 🔥) and stubborn inflation are muddying the waters. Cutting rates too soon could reignite price surges, while holding them risks slowing growth. Analysts say this 'wait-and-see' mode might linger until late 2024.

Mortgages, car loans, and credit card APRs? They’re staying pricey for now. 💳 First-time homebuyers and small businesses eyeing loans face continued pressure. 'The Fed’s playing it safe, but everyday wallets are feeling the pinch,' says economist Owen Fairclough.

📊 Markets wobbled slightly post-announcement, but most investors saw this coming. Next big clue: Friday’s jobs report. Stay tuned!

Reference(s):

cgtn.com