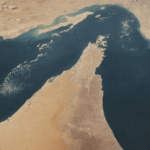

Iran’s parliament voted Sunday to potentially close the Strait of Hormuz – the world’s most vital oil chokepoint – escalating tensions after U.S. airstrikes targeted Iranian nuclear facilities. While the final decision rests with Iran’s Supreme National Security Council, the move has sent shockwaves through global markets. 💥

Why does this matter? The strait handles 20% of global oil and gas shipments. A blockade could spike prices to $120+/barrel, says Deutsche Bank’s George Saravelos. 🛢️ "This isn’t just about oil – it’s a domino effect," warns Allianz’s Mohamed El-Erian, highlighting risks to inflation, supply chains, and an already shaky global economy.

Shipping giants are already spooked. The Baltic and International Maritime Council reports fewer vessels daring to traverse Hormuz, with many rerouting to avoid conflict zones. 🚢⚡ Analysts say even a temporary closure could paralyze energy markets and hit consumers worldwide.

While experts call a full blockade a "last resort," the threat alone reveals how fragile global energy security remains. As geopolitical tensions rewrite trade maps, young professionals and travelers alike are bracing for ripple effects – from pricier flights to economic uncertainty. 🌐💸

Reference(s):

Analysis: What would happen if Iran blocked Strait of Hormuz?

cgtn.com