🌐 The Dollar’s Dominance Faces a BRICS-Sized Challenge

Move over, US dollar—BRICS nations (Brazil, Russia, India, China, South Africa) are making a power play. After Russia’s 2022 frozen dollar assets sent shockwaves through global markets, the bloc is accelerating its push for local currency settlements. Think of it like breaking up with a toxic ex: messy, but necessary for growth. 💔

🔍 Why the Sudden Shift?

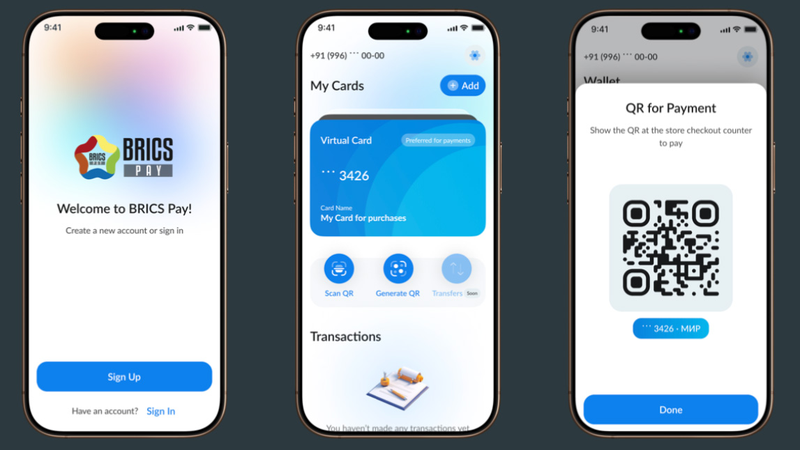

The dollar’s long reign as the world’s go-to currency is looking shaky. BRICS Pay, a new system enabling direct trade in local currencies, aims to create a financial 'safety net' against geopolitical risks. As one analyst put it: "This isn’t just about money—it’s about rewriting the rules of economic survival."

🚧 Roadblocks Ahead

But here’s the tea ☕: Building a new financial architecture isn’t like launching a TikTok trend. Three major hurdles stand out:

- Coordinating wildly different economies (from India’s tech boom to Russia’s energy focus)

- Creating trust in new payment systems

- Navigating the dollar’s still-mighty influence

💡 The Big Picture

While BRICS isn’t about to replace the dollar overnight, this move signals a tectonic shift in global economics. For young professionals and investors, it’s a wake-up call: diversify or risk getting left behind. 🌪️

Reference(s):

BRICS currency settlement: Promise and institutional challenge

cgtn.com