China’s real estate sector just got a major liquidity lifeline! 🌊 To tackle ongoing financial strains, authorities rolled out a city-level “whitelist” system in January, directing banks to prioritize loans for vetted residential projects. Think of it like a VIP pass for housing developments stuck in funding limbo. 🎟️

How It Works

Local governments screen projects struggling with short-term cash flow but deemed viable. Once approved, these projects get fast-tracked for bank financing. By February 20, over 5,300 projects nationwide had made the list, with $4 billion in loans already distributed—a 65% surge from late January. 💨

Why It Matters

This isn’t a blanket bailout. The focus is on completing homes, not propping up developers. By ensuring half-built apartments reach buyers, China aims to restore trust in a sector that’s been rattling consumer confidence. Analysts call it a “precision strike” to stabilize the market. 🎯

What’s Next?

While banks rush to process loans, regulators are watching closely to prevent funds from being diverted to land purchases or debt repayments. With recent rate cuts and expanded loan rules for commercial properties, experts say these moves could pave the way for a sustainable rebound. 🚧✨

Reference(s):

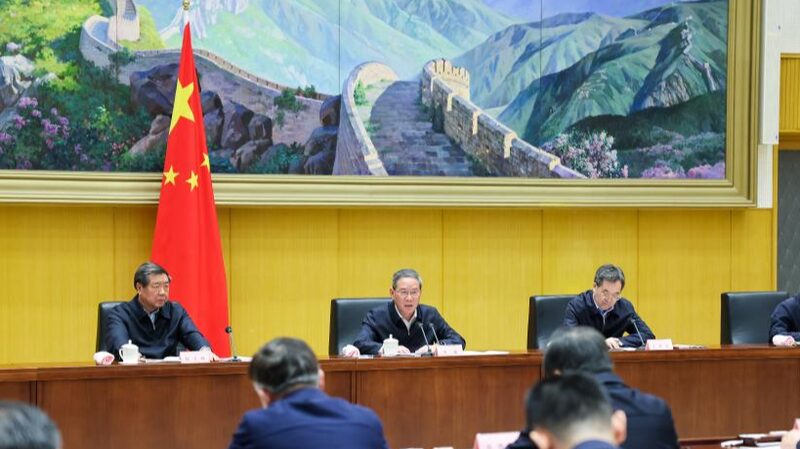

China's property financing support to promote healthy development

cgtn.com