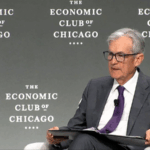

The Federal Reserve just dropped interest rates by 0.5% (50 basis points)—its sharpest cut in months—as inflation cools and job market trends shift. 🌡️💼 Former Fed Vice Chair Donald Kohn told CGTN’s He Jingyi that \\"the key is to start and keep cutting rates\\" to align with market expectations. Let’s unpack why this matters.

With prices rising more slowly and hiring losing steam, the Fed’s move aims to ease borrowing costs for everything from car loans to business expansions. 🚗🏢 Kohn stressed that pausing now could spook investors: \\"Markets will anticipate, so consistency is crucial.\\" Could this signal a longer-term rate drop trend? 📉 Analysts say watch for hints in next month’s jobs data.

For young professionals and entrepreneurs, lower rates might mean cheaper loans to launch that side hustle or refinance student debt. 💡🎓 But travelers, take note: the dollar’s dip could make overseas trips pricier. ✈️💸 Stay tuned as the Fed navigates this economic tightrope!

Reference(s):

Former Fed vice chair: Important to start and keep cutting rates

cgtn.com