Hold onto your wallets, global citizens! The upcoming BRICS+ summit in Kazan, Russia, is set to turbocharge the movement toward currency multipolarity – a fancy term for trading in national currencies instead of relying on the US dollar. 🚀 Think of it like ditching a single streaming platform for a buffet of options tailored to local tastes.

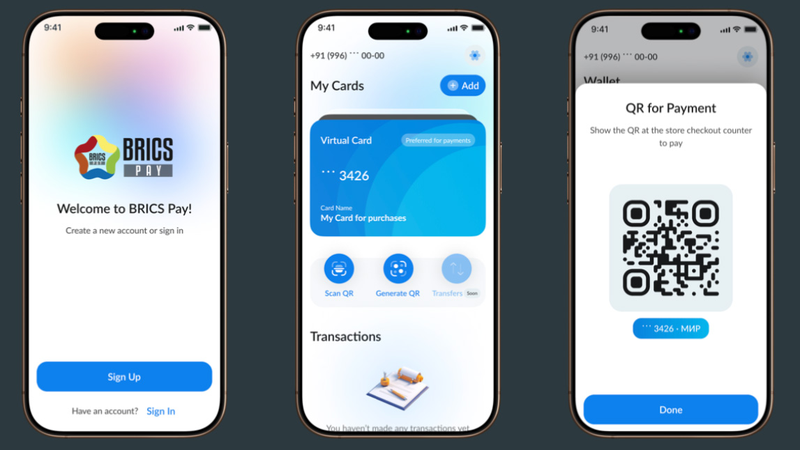

Warwick Powell, a senior fellow at Beijing Taihe Institute, calls this a “dynamic process” reshaping global finance. The summit will focus on creating a payment system that lets BRICS+ members (Brazil, Russia, India, China, South Africa, and new partners) settle trades directly in their own currencies. No more USD middleman! 💡

Why does this matter? For decades, the dollar has dominated global trade like the main character in a financial blockbuster. But BRICS+ economies – representing 40% of the world’s population – are now writing a new script. 📈 From blockchain tech to trade agreements, they’re building infrastructure to support what Powell calls “real economies of value creation.”

This isn’t just about economics; it’s geopolitical storytelling. As tensions over dollar-based sanctions grow, BRICS+ could offer countries an alternative narrative – one where trade isn’t tied to Western financial systems. 🌏 The Kazan summit might just be the plot twist we’ve been waiting for.

Reference(s):

BRICS and Currency Multipolarity: Adding to the emerging fabric

cgtn.com