The race to cash in on AI’s explosive growth just got faster. Asset managers are rolling out AI-themed ETFs at breakneck speed, with over a third of such funds launching in 2024 alone, per Morningstar data. 📊 The trend? Everyone’s betting big on AI—even if no one knows which companies will win long-term.

From BlackRock’s new actively managed ETFs to Amplify’s rebranded cloud-computing fund, firms are pivoting hard to capture the AI hype. 💡 'The AI market will change dramatically,' says Tony Kim of BlackRock, highlighting the scramble to stay ahead of emerging opportunities.

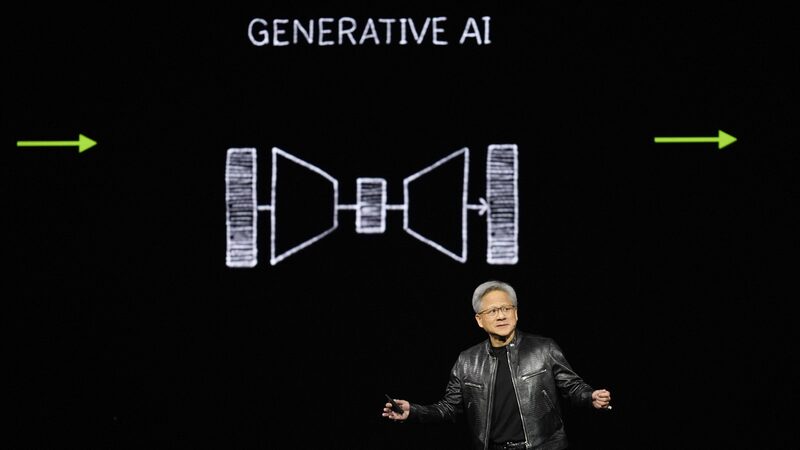

Why the frenzy? Look no further than Nvidia’s 200%+ stock surge in 12 months. But analysts warn: AI’s future winners could be broader—think cloud infrastructure, chipmakers, and even startups attracting $79B+ in VC funding this year. 💰

While AI ETFs like Global X’s are up 20% YTD, they’re still trailing the S&P 500. Yet, investors keep piling in, drawn by FOMO and the promise of a tech revolution. 🚨 As Bank of America puts it, an 'AI arms race' is heating up among giants like Microsoft and Amazon—with $206B in megacap spending this year alone.

Bottom line? AI ETFs are booming, but picking the right horse in this race? That’s still anyone’s guess. 🤖

Reference(s):

cgtn.com