China’s financial sector is rolling out the red carpet for global players! 🚀 Regulators have turbocharged market reforms this year, making it easier for foreign investors to dive into the world’s second-largest bond market while boosting the international role of the Chinese renminbi (RMB). Talk about a power move! 💪

RMB payments now make up 26.5% of cross-border trade transactions, with the currency ranking as the 4th most-used globally for payments and 3rd in IMF’s reserve assets. 🏦 Foreigners now hold a record 4.6 trillion yuan ($628B) in Chinese bonds – and that’s just the start.

Insurance giants like Belgium’s Ageas and Italy’s Generali are doubling down on China’s pension and tech-driven finance sectors. Ageas recently snapped up a 10% stake in Taiping Pension Insurance, calling China’s market a “goldmine of growth potential.” 💎 With 67 foreign insurers now operating in the country, assets in the sector have soared to 2.67 trillion yuan.

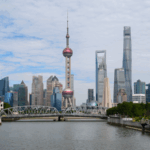

“Foreign investors are key drivers of China’s high-quality financial innovation,” says Xu Xian of the Shanghai Insurance Association. From green tech to digital finance, global players are helping shape the future of Asia’s economic powerhouse. 🌱💻

With ownership limits scrapped in banking, insurance, and asset management, China’s financial playground just got a lot bigger. Who’s ready to level up? 🎯

Reference(s):

China boosts financial openness, promotes two-way market integration

cgtn.com