China’s bold approach to funding long-term tech projects, dubbed ‘patient capital,’ is rewriting the rules of innovation—and the results are turning heads globally. 🌏💡

Rewiring the Startup Mindset

Forget the Silicon Valley ‘move fast and break things’ mantra. In China, tech companies are getting breathing room to dream bigger. Traditional investors often demand quick returns, pressuring startups to prioritize profits over breakthroughs. But ‘patient capital’ lets firms skip the IPO rush, with some funds delaying profit checks for 8+ years—like a Beijing AI fund with no exit deadline. 🕰️

R&D on Steroids

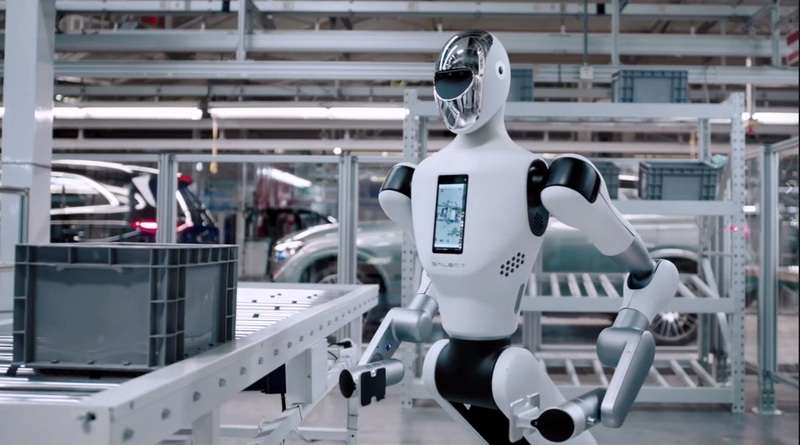

The payoff? Companies on Shanghai’s tech-focused stock board now pour 35% of resources into R&D—up from the industry’s 15% average. From biotech labs to AI hubs, this shift is breeding high-risk, high-reward innovation that could shape everything from healthcare to smart cities. 🧪🤖

Why It Matters

This isn’t just about China’s tech scene. By betting on ideas that take years to mature, ‘patient capital’ could unlock solutions for global challenges like climate change and disease. As one analyst put it: ‘When money stops clock-watching, science gets revolutionary.’ 🔥

Reference(s):

China's 'patient capital' and its paradigm shifts across three levels

cgtn.com