Trade Tensions Spark Financial Chaos Worldwide

Global markets plunged into chaos Monday as fears of a 1930s-style trade war sent stocks tumbling. The trigger? U.S. President Donald Trump’s new ‘reciprocal tariffs’ announced last week—a sweeping 10% baseline levy on all imports, with punitive rates up to 49% for targeted economies like China and Vietnam. 📉

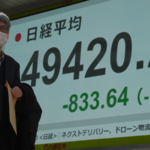

Asia Takes the First Hit

Asian markets opened like a scene from a disaster movie. Japan’s Nikkei 225 nosedived nearly 9% before settling at a 7.83% loss—its worst day in eight months. South Korea’s KOSPI froze trading after a 5.57% drop, while Hong Kong’s Hang Seng Index crashed 13.2%, marking its steepest fall since 1997. The Chinese mainland’s Shanghai Composite dropped 7.34%, with over 2,900 stocks hitting the daily limit. Even the Taiwan region’s benchmark index plummeted 9.7%, triggering circuit breakers. 💥

Europe & Wall Street Follow the Nosedive

By afternoon in London, Europe’s Stoxx 600 had fallen 3.8%, with Germany’s DAX and France’s CAC 40 down 3.75% and 4%, respectively. Wall Street opened to panic: the Nasdaq and S&P 500 both sank 4% early on, continuing last week’s historic $5 trillion wipeout. Tech giants like Nvidia and Tesla remained in freefall, down over 15% since Thursday. 😱

The Domino Effect

Trump’s ‘economic medicine’ has sparked global backlash. Canada slapped 25% tariffs on U.S. autos, the EU prepped countermeasures, and protests erupted in 50 U.S. states and European capitals. J.P. Morgan warns of a 60% chance of global recession—a scenario that’s got everyone from investors to academics glued to their screens. 🤯

Will central banks intervene? Can the downturn be reversed? Stay tuned as this story develops.

Reference(s):

Global financial markets extend losses amid Trump tariff crisis

cgtn.com