US footwear giant Skechers is making headlines with a massive $9.4 billion deal to go private—but the sale comes with a twist tied to former President Donald Trump's tariff policies. 🤯 The California-based sneaker empire, known for its comfy kicks and celeb collabs, will be acquired by private equity firm 3G Capital, according to a Monday announcement.

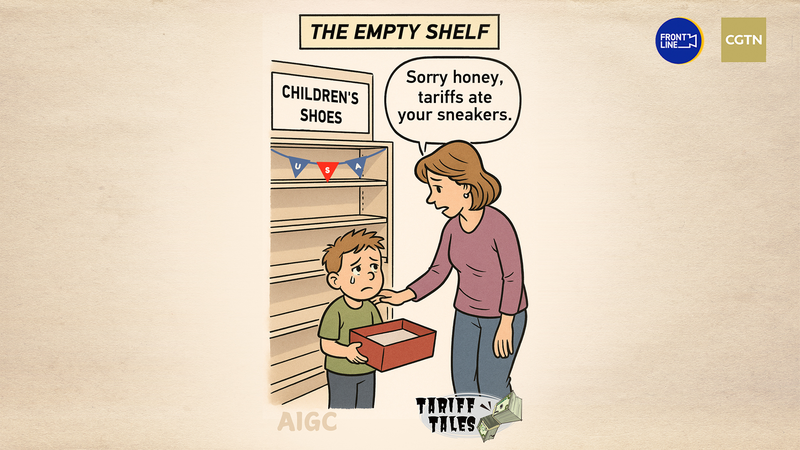

While neither side directly blamed Trump-era tariffs in their press releases, industry experts are connecting the dots. 🔍 Over 80% of Skechers’ shoes are made in Asia, and companies like Nike and Adidas recently warned that Trump’s proposed tariffs could "fundamentally hamper our industry". A coalition letter to Trump argued that tariffs on footwear could spike prices up to 220% for items like kids’ shoes—hitting both businesses and families.

📉 Skechers, which posted record $9B revenue in 2024, saw stocks drop this year as investors worried about "macroeconomic uncertainty" from trade policies. CFO John Vandemore even compared the tariff chaos to "the pandemic" in its disruptive force. Meanwhile, the company plans to keep CEO Robert Greenberg at the helm post-sale.

Will this mega-deal help Skechers dodge the tariff storm? 🌩️ Analysts say going private might give the brand flexibility to navigate rising costs and supply chain headaches. But with US footwear giants pushing back hard, this story’s just getting its laces tied. 👟💼

Reference(s):

US footwear giant Skechers to be sold under shadow of Trump's tariffs

cgtn.com