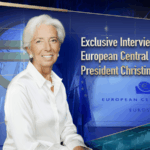

European Central Bank President Christine Lagarde just dropped a bold vision for the euro’s future – and it’s all about #CurrencyClout. At a Berlin event, she declared the U.S. dollar’s decades-long dominance is looking shaky, creating what she calls a ‘global euro moment’ 🌐💡.

Why Europe’s Pushing for Power

Lagarde warned that relying on the dollar leaves Europe vulnerable to global economic drama. With the greenback’s share of foreign reserves at a 30-year low 📉, she sees room for the euro to flex: ‘This isn’t about replacing the dollar – it’s about Europe controlling its destiny.’

Three Keys to Euro Dominance

Her playbook? 1️⃣ Keep trade flowing freely (with security backup), 2️⃣ Make eurozone economies irresistible to investors, and 3️⃣ Double down on rule of law. ‘We won’t win by accident,’ she stressed – it’s time for strategic moves 🏛️💼.

What’s at Stake?

Boost the euro’s 20% global reserve share, and Europe could slash borrowing costs 💸, stabilize markets, and become less dependent on external shocks. But Lagarde knows it’s a marathon, not a sprint – especially as central banks stockpile gold like it’s 1999 🏦🥇.

Reference(s):

ECB chief calls for stronger role of euro, points to dollar decline

cgtn.com