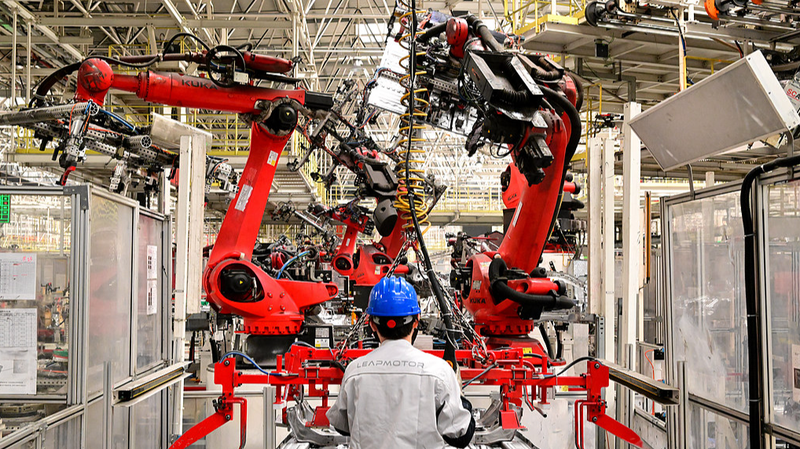

European companies in China are facing a paradox: tougher business conditions and deeper local investments. A new 2025 survey by the European Union Chamber of Commerce in China and Roland Berger reveals 73% of firms found operating in the country more challenging in 2024—up 5% from last year. Yet 26% are expanding local supply chains, betting on China’s manufacturing muscle. 💼📉➡️📈

Why the Mixed Signals?

Market competition is heating up like a K-pop dance-off 🔥, with regulatory hurdles and geopolitical tensions adding to the stress. But here’s the kicker: China’s ability to deliver high-quality, low-cost components remains unmatched, according to Jens Eskelund of the EU Chamber. Think of it as the 'Taylor Swift effect'—everyone wants a piece of the magic, even if tickets are pricey. 🎤

Localize or Lose

Roland Berger’s Denis Depoux says companies must now go hyper-local, from R&D to customer service, to stay competitive. China’s new Private Economy Promotion Law (enacted May 20) and recent State Council financial measures aim to sweeten the deal for foreign investors. 💡📜

The Bottom Line

While growth slows, China’s economy is stabilizing, not collapsing. For global firms, it’s a high-stakes game of chess—navigate the challenges, reap supply chain rewards. 🏭♟️

Reference(s):

European firms face China challenges but boost local supply chains

cgtn.com