Rising US tariffs are fueling inflation worries and economic jitters as growth stumbles—and young consumers, investors, and professionals are feeling the heat. Let’s break it down. 🔥

Economic Contraction Hits

The US economy shrank 0.2% in early 2025, its first decline in three years. Surging imports and lower government spending dragged growth down, with the trade deficit alone slashing nearly 5% off GDP. 📉

Inflation Pressures Linger

The Fed’s go-to inflation gauge, the core PCE index, hit 3.4% in Q1—still way above the 2% target. All eyes are on Friday’s April data to see if prices cool further. 🧐

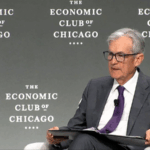

Fed’s Cautious Stance

Fed officials are playing it safe, calling the outlook "exceptionally uncertain." Atlanta Fed President Raphael Bostic wants just one rate cut this year, saying, "We need clarity before acting." 🛑

Consumer Sentiment Rollercoaster

The Expectations Index jumped 17 points to 72.8, but it’s still below the 80 mark that signals recession risks. Translation: Folks are hopeful but nervous. 🎢

Stagflation Warning Lights

JPMorgan CEO Jamie Dimon dropped the S-word: "Stagflation—recession plus high inflation—isn’t off the table." Think 1970s vibes, but with TikTok economics. 😬

As tariffs, inflation, and shaky confidence collide, the US economy’s next move could redefine 2025. Stay tuned. 📈📉

Reference(s):

US tariff policies heighten inflation concerns amid slowing economy

cgtn.com