Global investment giants like Goldman Sachs, J.P. Morgan, and Morgan Stanley are betting big on China’s economic resilience, upgrading their 2025 GDP growth forecasts amid stronger-than-expected policy moves and trade breakthroughs. 🚀

Why the Optimism?

Goldman Sachs lifted its 2025 forecast to 4.6% (up from 4%), crediting China’s export rebound and a surge in retail sales fueled by government trade-in programs. Nomura echoed this, raising Q2 predictions to 4.8% growth as U.S.-China trade tensions ease. 💼

Policy Power-Up

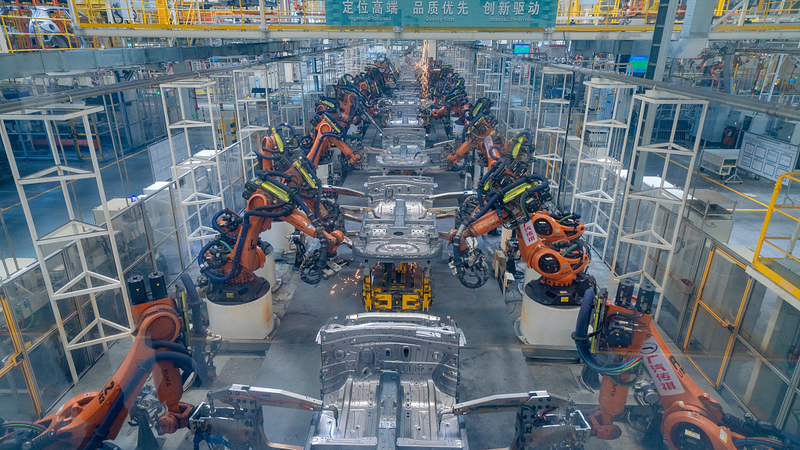

J.P. Morgan’s Zhu Haibin highlighted China’s "profound policy adjustments," including expanded fiscal spending and debt management. Morgan Stanley’s Xing Ziqiang added that AI innovation and consumer trade-in schemes are unlocking new growth avenues. 🤖🛍️

Retail Resilience

April’s 5.1% retail sales jump—driven by subsidies for electronics and EVs—signals robust domestic demand. Standard Chartered noted infrastructure investments and bond issuances will keep momentum strong through mid-2024. 🔋

Global Confidence

UBS’s Thomas Fang praised China’s "predictable confidence boost" to markets, while Citigroup and Carlyle Group leaders reaffirmed long-term partnerships. 🌐

With AI and green tech reshaping industries, China’s economic playbook is winning Wall Street’s vote—for now.

Reference(s):

Major investment banks raise 2025 China economic growth forecasts

cgtn.com