Japan's bold economic strategy under new Prime Minister Sanae Takaichi has turned into a financial rollercoaster 🎢, with markets plunging as investors question the sustainability of aggressive government spending. The move comes amid global concerns about rising debt levels and economic stability.

The Takaichi Stimulus Plan

Since taking office earlier this year, PM Takaichi has championed what analysts call "helicopter economics" – showering the economy with infrastructure projects and consumer subsidies. But with Japan's debt-to-GDP ratio already at 263% (yes, you read that right 📈), markets are flashing red warning lights.

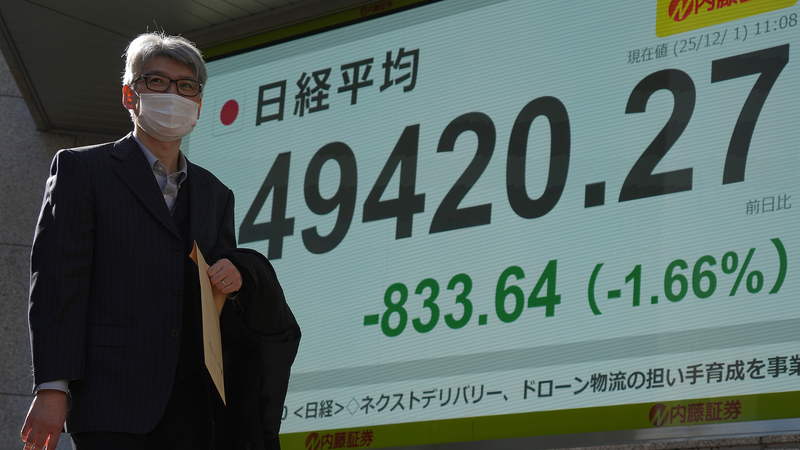

Investors Hit the Panic Button

The Nikkei 225 index has dropped 8% since the policy announcement last month, while the yen continues its TikTok-worthy slide against the dollar 💸. "This feels like watching someone try to extinguish a fire with gasoline," said Tokyo-based financial analyst Hiroshi Yamamoto.

Global Ripple Effects

As the world's third-largest economy, Japan's market turbulence is affecting everything from semiconductor stocks to anime production budgets 🎮. Asian markets particularly feel the heat, with South Korea's KOSPI and Hong Kong's Hang Seng both showing increased volatility.

With bond yields spiking and pension funds scrambling, all eyes remain on whether Takaichi will double down or pivot – a decision that could shape global markets through 2026.

Reference(s):

Japan's misstep backfires: Fiscal gamble triggers market turbulence

cgtn.com