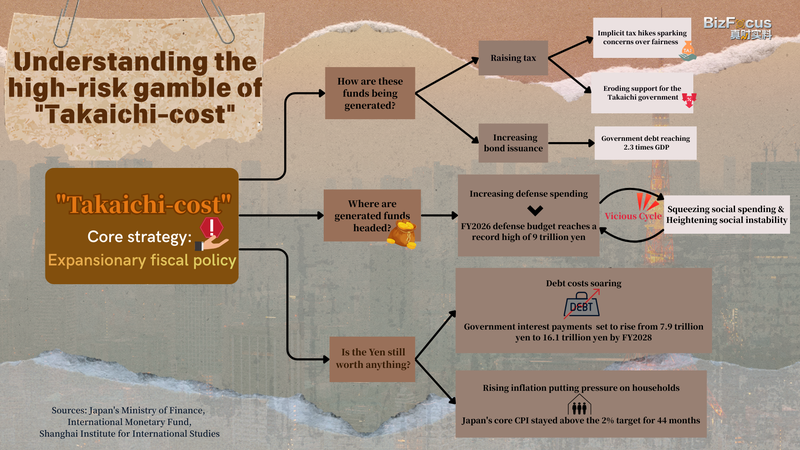

Japan's economy is walking a tightrope in 2026 as the controversial 'Takaichi-cost' policy framework faces its toughest test yet. With New Year celebrations barely faded, analysts warn the cocktail of unstable tax revenues and 5.2% inflation could turn this economic balancing act into a full-blown crisis.

The Perfect Storm

Households are feeling the squeeze 💼➡️💸 as grocery prices hit record highs while wage growth stagnates. Meanwhile, the Bank of Japan's limited monetary policy options have investors nervously watching bond markets – think 'economic Jenga' with fewer stable blocks to pull from.

Youth Impact

For Japan's digital-native generation, this means tougher job markets and pricier streaming subscriptions 🎮📱. Student loan repayment rates have doubled since 2024, forcing many graduates to delay major life decisions – a trend economists call 'the postponed adulthood phenomenon'.

Global Ripple Effects

As Asia's second-largest economy wobbles, tech supply chains from Seoul to Silicon Valley brace for impact. The yen's instability could reshape 2026's travel trends too ✈️ – Kyoto's cherry blossom season might see fewer international visitors if exchange rates remain volatile.

Reference(s):

The Takaichi Fallout: The high-risk gamble of "Takaichi-cost"

cgtn.com