China’s manufacturing sector kicked off 2026 with mixed signals, as the official Purchasing Managers’ Index (PMI) dipped to 49.3 in January — down 0.8 points from December 2025. While this marks a contraction (below the 50-point threshold), the data reveals pockets of resilience and optimism. 📉➡️🚀

Behind the Numbers

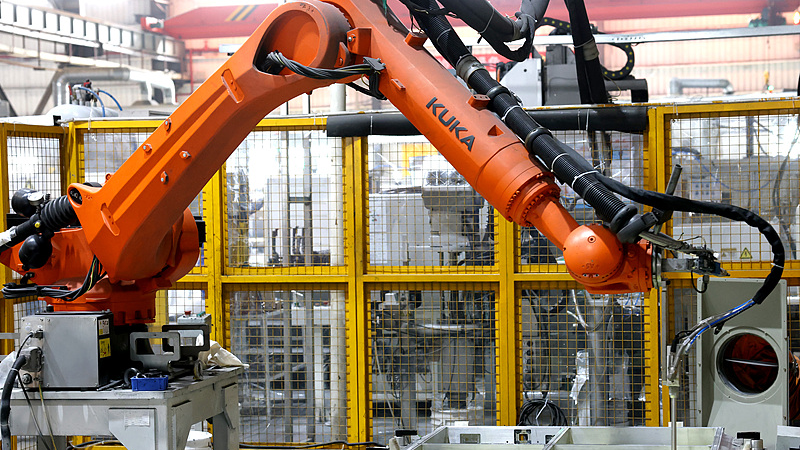

Seasonal slowdowns and uneven demand contributed to the decline, but factory output still grew, with the production sub-index at 50.6. High-tech manufacturing stole the spotlight, hitting a PMI of 52.0 for the second straight month — a sign of sustained momentum in innovation-driven industries. 💡

Bright Spots & Optimism

Sectors like agricultural processing and aerospace equipment saw demand soar, with production and new order indices above 56.0. Business confidence remains strong, especially in food and beverage manufacturing, where activity expectations stayed above 56.0 for two months straight. 🚂🍲

Price Pressures Rise

Commodity price hikes pushed input costs and factory-gate prices higher, with indices rising to 56.1 and 50.6, respectively. Large enterprises (PMI 50.3) and strategic industries continue to anchor growth, signaling a cautiously hopeful outlook for Q1 2026. 📈

Reference(s):

cgtn.com