Global markets are holding their breath as President Trump’s nomination of Kevin Warsh to lead the Federal Reserve sparks a high-stakes showdown over central bank independence. 💥 The move triggered chaos last week, with gold prices plunging 12% and silver nosediving 34% – the sharpest single-day drops in decades. Analysts call it the "Warsh Shock," reflecting fears his hawkish stance could accelerate balance sheet cuts.

Trump vs. The Fed: A 2026 Standoff

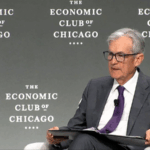

Since 2025, Trump has publicly clashed with outgoing Chair Jerome Powell over interest rates, demanding slashes to 1% to boost economic growth. 🚨 Despite pressure tactics – including legal threats over Fed building renovations and the controversial ousting of board member Lisa Cook – Powell held rates at 3.5-3.75%, citing the Fed’s dual mandate to control inflation (currently at 2.8%) and maintain employment stability.

Warsh’s Wild Card

All eyes now turn to Warsh, whose Senate confirmation could reshape global finance by late May 2026. Critics ask: Will he uphold the Fed’s 113-year tradition of political neutrality, or become a "Trump enabler"? 📉 The nominee’s past calls for aggressive monetary tightening clash with Trump’s demands for cheaper credit – setting up what analysts dub "the ultimate loyalty paradox."

What’s Next?

Markets will scrutinize this week’s precious metal rebounds for clues. Meanwhile, legal experts warn Trump’s unprecedented interference could destabilize the dollar’s global standing. As one Wall Street trader told us: "This isn’t just about rates – it’s about whether America’s financial system stays credible." 🔍

Reference(s):

cgtn.com