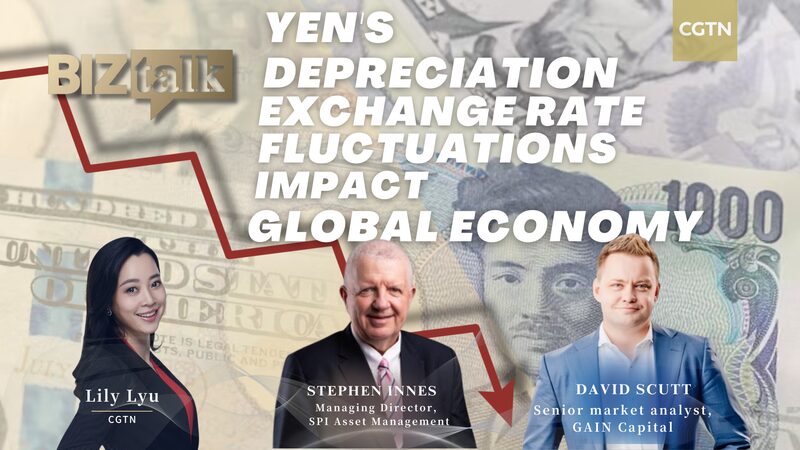

Japan’s financial markets are reeling as Prime Minister Sanae Takaichi’s surprise call for an early election triggers a historic bond and currency sell-off. With long-term government bond yields hitting 30-year highs and the yen flirting with 160 against the dollar, investors are sounding alarms about the nation’s economic direction. 💥

The turmoil comes amid growing skepticism about Japan’s fiscal discipline – the country’s debt-to-GDP ratio remains the highest among developed economies. Analysts warn this 'twin crisis' reflects deeper fears: Can Tokyo balance geopolitical ambitions with sustainable economic policies? 🌐

"This isn’t just about election nerves," says Yang Hangjun, a professor at the University of International Business and Economics. "Markets are questioning whether Japan can maintain policy stability while navigating U.S.-China tensions and domestic demographic challenges." 📊

Young professionals and investors are watching closely. With Japan still Asia’s second-largest economy, the outcome could ripple through global markets – from tech supply chains to climate investment strategies. Stay tuned as we track this developing story. 🔍✨

Reference(s):

Sell-off highlights Japan's economic uncertainty ahead of election

cgtn.com