China’s latest tariff adjustments on semiconductors have clarified which chips face heavy duties—and the rules are reshaping global tech stocks 🌏. According to the China Semiconductor Industry Association (CSIA), only chips manufactured in U.S.-based factories will be subject to a 125% tariff, sparing those produced in the Taiwan region and South Korea 🚨.

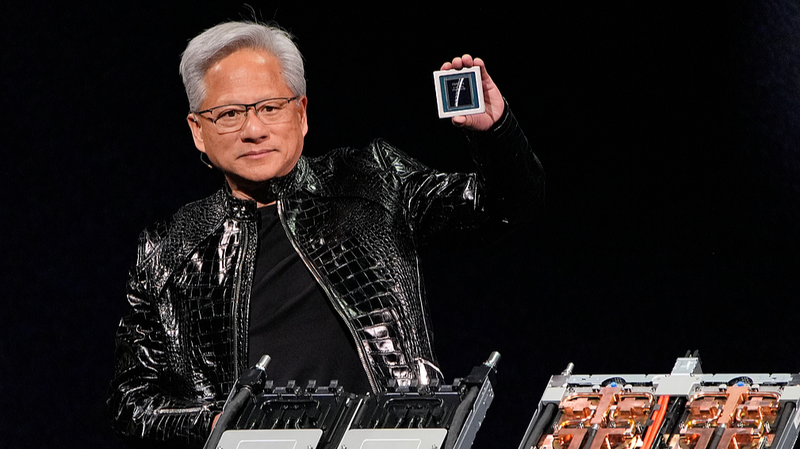

The key? It’s all about where the silicon wafer is made, not where the chip is designed or packaged. Think AMD and Nvidia GPUs (made in Taiwan fabs) vs. Intel processors (built in U.S. plants). Result? AMD shares jumped 6%, while Intel slumped over 6% 📈📉.

Analysts say this "fab-first" rule could push foreign firms to adopt a "China for China" strategy—manufacturing locally to dodge tariffs. "This clarifies which U.S. chips get hit," said tech researcher He Hui. "Domestic supply chains could benefit big time." 💼⚡

Meanwhile, Bernstein analysts called the CSIA move a "market surprise," noting shifting wafer fabs is way harder than rearranging packaging hubs. With Beijing retaliating against U.S. trade policies, the tech cold war’s supply chain chessboard just got more complex. ♟️🌐

Reference(s):

China's tariff on chips is not as widespread as you might think

cgtn.com