China’s economy is serving up a mixed bag of foreign investment trends in 2025, with tech-driven sectors stealing the spotlight 🚀. While total foreign capital dipped slightly, a surge in new global businesses and high-tech partnerships shows international confidence isn’t flatlining—it’s just getting smarter.

By the Numbers: New Firms vs. Capital Flow

From January to September, a whopping 48,921 new foreign-funded enterprises set up shop in China—a 16.2% jump from 2024! But actual utilized foreign capital fell 10.4% to 573.75 billion yuan ($78.7 billion). The plot twist? September saw an 11.2% rebound 💹, hinting at renewed momentum.

Tech Takes Center Stage 🔬

High-tech industries raked in 170.84 billion yuan, with e-commerce services exploding by 155.2% 📦. Aerospace and medical tech also soared, proving innovation is China’s new currency. Meanwhile, manufacturing (150.09B yuan) and services (410.93B yuan) held steady.

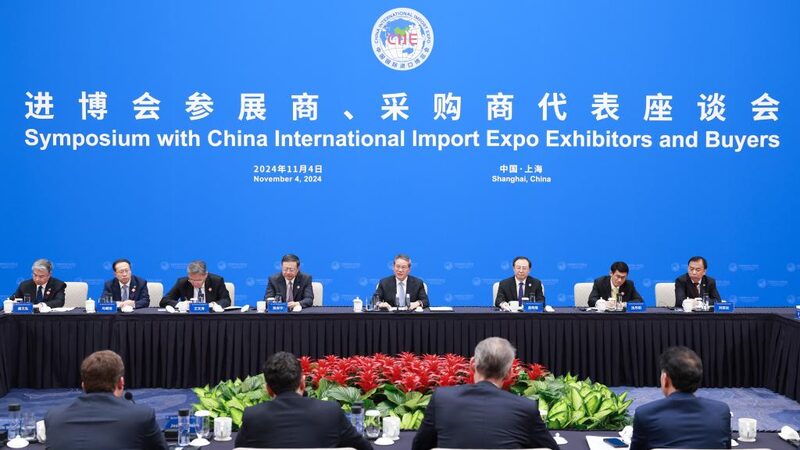

Global Players Double Down 🌍

Japan led the charge with a 55.5% investment spike, followed by the UAE (48.7%) and the UK (21.1%). Even Switzerland joined the party with a 19.7% boost 🎉. These numbers scream one thing: multinationals still see China as a critical hub for growth and R&D.

As Beijing pivots toward high-value industries, the world’s watching to see if this tech-first strategy can redefine global supply chains. Stay tuned! 🔍

Reference(s):

China draws $78.7 billion in foreign investment in first nine months

cgtn.com