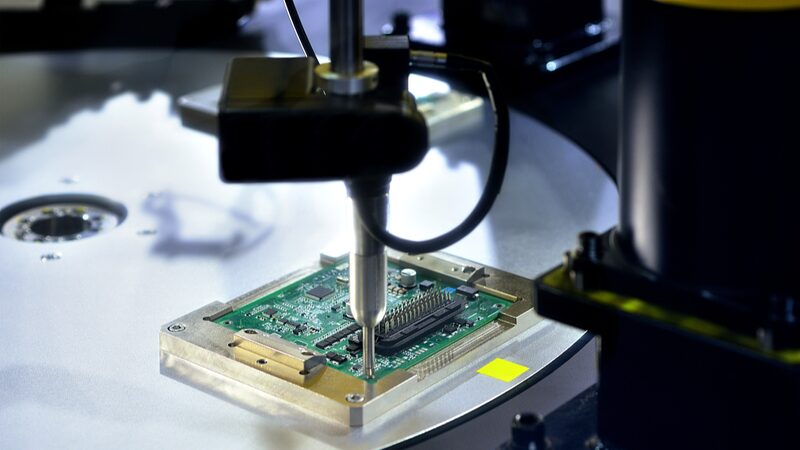

Dutch tech giant ASML remains bullish on its Chinese mainland business, projecting that 20% of its future revenue will come from the region despite ongoing export restrictions. CFO Roger Dassen confirmed the outlook this week, highlighting China's enduring role in global semiconductor supply chains. 💼🔌

While advanced EUV lithography machines remain blocked from export to China under U.S.-led policies, ASML still sold $8.2 billion worth of less advanced DUV systems to Chinese clients in 2025—accounting for 33% of its global sales. 📈 The restrictions, first imposed in 2018, have forced China to accelerate domestic innovation, with Beijing unveiling plans in 2024 to develop 65nm lithography systems by 2026. 🔬

Tech Independence Meets Global Trade

China's semiconductor ambitions are heating up: The country's AI chip market is projected to hit ¥1 trillion ($140B) by 2028, capturing 30% of global demand. 🌐 Analysts say this growth could create new partnerships between Chinese firms and overseas players like ASML, even as geopolitical tensions simmer.

"Innovation isn't a zero-sum game," noted tech analyst Li Wei in Science and Technology Daily. "China's push for self-reliance might actually open doors for smarter global collaboration." 🚪✨

Reference(s):

cgtn.com