When Disaster Strikes, Insurance Shields China’s Farmers

Picture this: a farmer in Henan Province stares at fields drowning under relentless rain. A year’s labor—gone in days. But thanks to China’s expanding agricultural insurance policies, this story doesn’t end in despair. 🌧️➡️💰

By the Numbers: Protecting the ‘Rice Bowl’

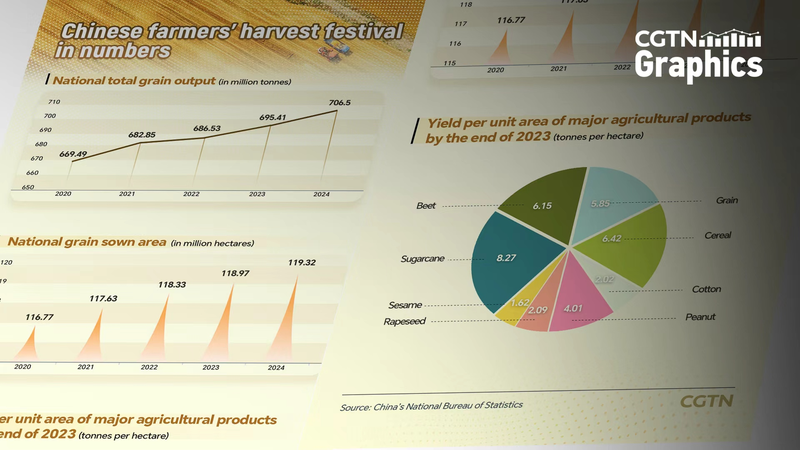

With 700 million tonnes of annual grain production, China’s food security is no small feat. But climate chaos hits hard—29 million tonnes of grain losses yearly from disasters. Enter agricultural insurance, paying out 112.4 billion yuan ($15.5B) in 2023 alone, up 25.4% YoY. 🚜💸

How It Works: Three Policies, One Goal

Farmers choose from:

- Basic coverage (525 yuan/mu, 5.1 yuan farmer cost)

- Full-cost insurance (double compensation for disasters)

- Planting income insurance (payouts rise with disaster severity)

Gov subsidies cover up to 80% of premiums, making safety accessible. 🛡️

Real-Life Wins: From Floods to Payouts

In 2023, Henan’s wheat farmers received 2.6 billion yuan after rains ruined harvests. A Harbin合作社 cooperative paid ‘a few thousand yuan’ in premiums but got hundreds of thousands back after floods. 🌾→🏦

Why It Matters: Confidence to Grow

With 500,000+ cooperatives and 1.7 million family farms, these policies let farmers plant boldly. Results? 9 straight years of harvests over 695 million tonnes. 📈

As Vice Finance Minister Liao Min says: ‘China’s rice bowl stays in our hands.’ 🍚👐

Reference(s):

Agricultural insurance serves as all-weather friend to food security

cgtn.com