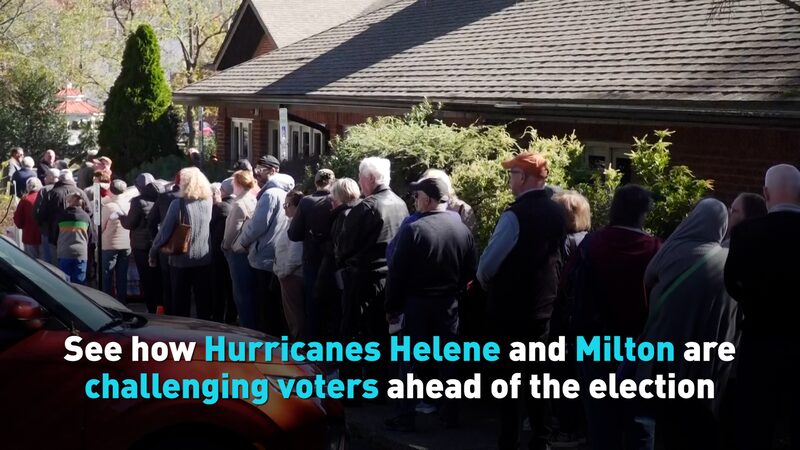

Back-to-Back Storms Highlight Costly Coverage Gaps

As Florida braces for Category 5 Hurricane Milton, millions are watching the aftermath of Hurricane Helene – a “crushing reality check” about America’s growing insurance gap. Over 90% of flood-prone U.S. properties lack federal flood coverage, leaving families vulnerable as climate disasters intensify. 💸

The $30 Billion Wake-Up Call

Helene’s September rampage caused up to $47.5 billion in damages, with 40% of losses uninsured. “Most homeowners don’t realize standard policies exclude floods,” experts warn, forcing many to drain savings or rely on limited federal aid. CoreLogic data reveals only 8% of at-risk properties had National Flood Insurance Program coverage in 2023 – and premiums keep rising. 📈

Climate Chaos Meets Corporate Calculus

With NOAA confirming 2023 as Earth’s hottest year in 174 years, insurers are hiking rates to offset $2.6 trillion in weather-related losses since 1980. Florida State professor Charles Nyce predicts a “two-tier system” where wealthier residents can afford protection while others gamble with climate fate. 🎲

As Milton approaches, one question looms: Can the U.S. reinvent disaster preparedness before the next superstorm? 🌊

Reference(s):

Multiple hurricanes raise grave concerns about U.S. insurance gap

cgtn.com