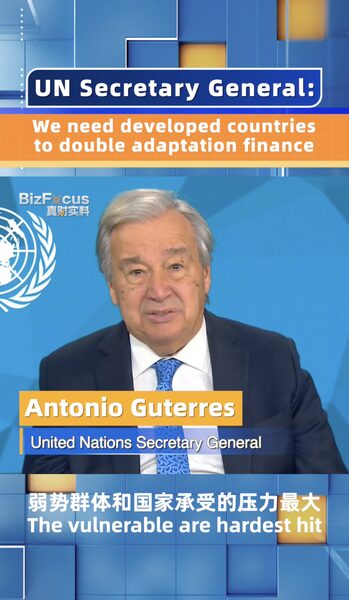

Climate disasters are escalating—from floods in Pakistan to drought in the Horn of Africa—yet the world’s top financial institutions are still under-delivering on climate action. 🌪️ Multilateral Development Banks (MDBs), like the World Bank, currently funnel just $100 billion annually to developing nations, a drop in the ocean compared to the $2.4 trillion experts say is needed yearly to fight climate change. 💸

At recent global summits, leaders called for urgent reforms. The Bridgetown Initiative, spearheaded by Barbados’ Prime Minister Mia Amor Mottley, demands a holistic overhaul of climate finance. Meanwhile, proposals to boost MDB lending by $100 billion annually—without new taxpayer money—are gaining traction. 🚀 Key strategies include:

- Unlocking $75B via smarter use of existing MDB capital (thanks to G20 recommendations).

- De-risking loans with partial guarantees to attract private investors.

But hurdles remain. Projects like flood defenses or climate-proof schools aren’t ‘profitable’ enough for private players, leaving MDBs as the lifeline. 🌱 While U.S. Treasury Secretary Janet Yellen and others back these reforms, time is ticking. As one expert put it: \"We’re fighting a wildfire with a squirt gun.\" 🔥

Reference(s):

Readying the multilateral development banks for the climate fight

cgtn.com