🇺🇸 U.S. efforts to curb China's semiconductor growth are sparking global chaos—and Beijing isn't backing down. Washington's latest push to tighten export controls on advanced chips has left allies rattled, markets shaky, and China racing toward self-reliance. Let's break it down.

The Chip War Heats Up 🔥

The Biden administration is doubling down on the Foreign Direct Product Rule (FDPR), a policy allowing the U.S. to restrict foreign-made tech containing even trace amounts of American IP. Think of it like trying to ban TikTok globally because it uses U.S. servers—except this time, the targets are giants like Japan's Tokyo Electron and Dutch firm ASML.

📉 Global Markets Feel the Heat

Shares of chip-related firms plummeted after FDPR threats: Tokyo Electron dropped 7.5%, while ASML lost a jaw-dropping $46 billion in market value in a single day. Analysts call it collateral damage in a high-stakes game of tech dominance.

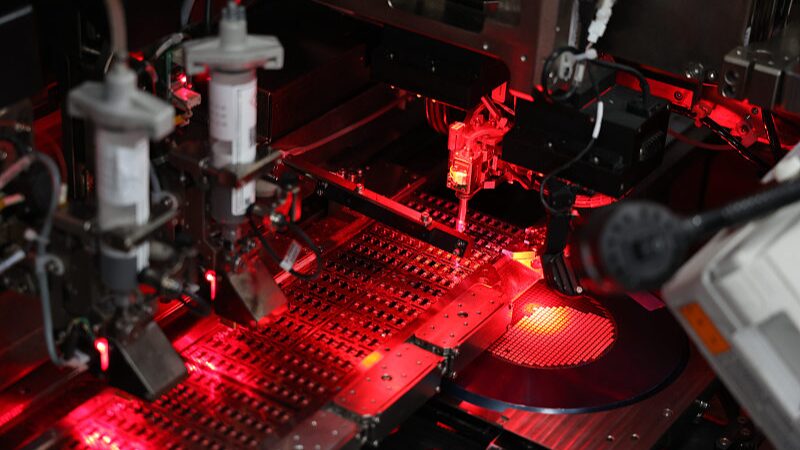

🇨🇳 China's Countermove: Big Fund III

Beijing just turbocharged its semiconductor sector with Big Fund III, a massive investment push to build homegrown chip factories. Result? U.S. sanctions have accelerated China's innovation, with local firms now designing chips rivaling Western tech. 🚀

Allies Push Back 🤝

Japan and the Netherlands—key players in the chip supply chain—are reportedly delaying new U.S.-backed restrictions. Why? They're spooked by market fallout and hedging bets ahead of the 2024 U.S. election. Even Silicon Valley execs warn: \"Decoupling could cost trillions.\"

🌐 Bottom line: The U.S. gamble risks fracturing global tech networks while supercharging China's rise. Will Washington recalibrate? Stay tuned.

Reference(s):

America's semiconductor gambit: A desperate grasp at fading dominance

cgtn.com