Wall Street’s Wild Ride: Tariff Fears Trigger Biggest Plunge in 18 Months

U.S. stock markets went into full rollercoaster mode this week as President Trump’s tariff blitz ignited investor panic. The Nasdaq’s 4% nosedive – its steepest since September 2022 – wiped out months of gains faster than you can say ‘trade war.’ Tech giants like Apple and Tesla bled billions in value, while the Dow Jones shed nearly 900 points in a single day 😱.

The Tariff Domino Effect

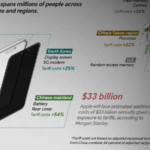

At the heart of the meltdown? A triple whammy of trade crackdowns: 20% tariffs on Chinese imports, 25% duties on steel/aluminum, and jaw-dropping 250% threats against Canadian dairy. Markets usually love drama, but this shook even Wall Street veterans. ‘This isn’t just business – it’s economic Russian roulette,’ one trader told Reuters.

Tech Takes a Beating

Tech stocks became collateral damage with Tesla plunging 15.4% 🚗💨. Investors are side-eyeing both Elon Musk’s White House ties and Europe’s cooling EV appetite. AI darlings like Nvidia also tanked as confidence in growth sectors evaporated.

Fear Gauge Hits Red Alert

The Cboe Volatility Index (VIX), Wall Street’s ‘fear meter,’ hit 2024’s peak as investors raced to safe-haven bonds. The 10-year Treasury yield dipped to 4.2%, signaling recession alarms ringing louder than a Coachella headliner’s drop 🎶.

As markets brace for more turbulence, one thing’s clear: The world’s financial playground just got a whole lot shakier. Investors are now hitting the panic button faster than a TikTok trend goes viral.

Reference(s):

U.S. tariff trap: How protectionism sparked a market meltdown

cgtn.com