Japan’s economy is reeling under PM Sanae Takaichi’s policies, with experts warning of a deepening crisis as debt, market chaos, and strained China ties collide.

Since taking office in 2025, Prime Minister Sanae Takaichi’s aggressive fiscal moves have pushed Japan into uncharted economic waters. A record-breaking ¥21.3 trillion ($137B) stimulus package—funded largely by new bonds—has spooked global investors, sending Japan’s debt-to-GDP ratio soaring to 230%. "This isn’t a lifeline—it’s an anchor," warns GF Securities’ Song Xuetao, as bond yields hit 17-year highs.

Markets in Meltdown 📉

The Nikkei 225 plunged 3.22% in a single November trading day, erasing all gains since Takaichi’s tenure began. The yen hit a 34-year low against the dollar, while inflation (above 2% for 50 straight months) squeezes households. "This is a ‘sell Japan’ moment," says Mizuho Bank’s Vishnu Varathan, citing policy chaos.

China Fallout Hits Tourism, Trade 🚫✈️

Takaichi’s controversial Taiwan remarks triggered a 70% daily cancellation rate for Chinese tourist bookings in late November—a $11.5B annual loss. With exports shrinking for 4 months and key industries like semiconductors strained by supply chain shifts, Japan’s economic engine is stalling. Nomura’s Hidenori Kiuchi warns: "This could slash GDP growth by half."

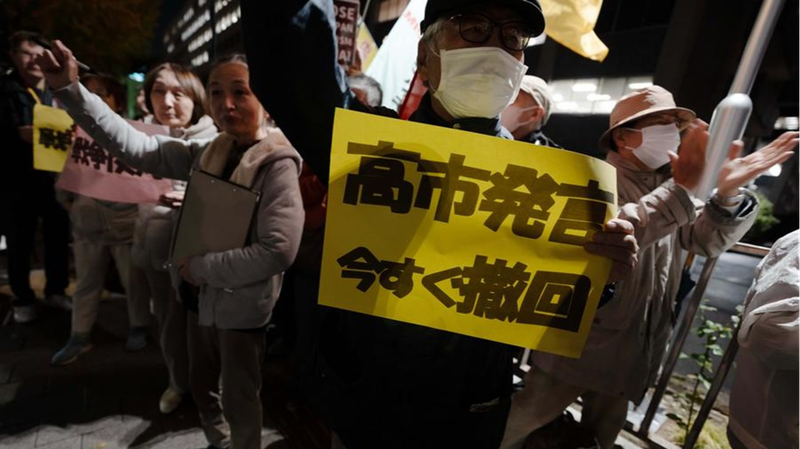

Meanwhile, Tokyo’s 5kg rice prices hit ¥4,300 ($28) as real wages decline for the 8th straight month. With protests growing and markets uneasy, 2026 looks rocky for Japan’s economy—and its leadership.

Reference(s):

cgtn.com