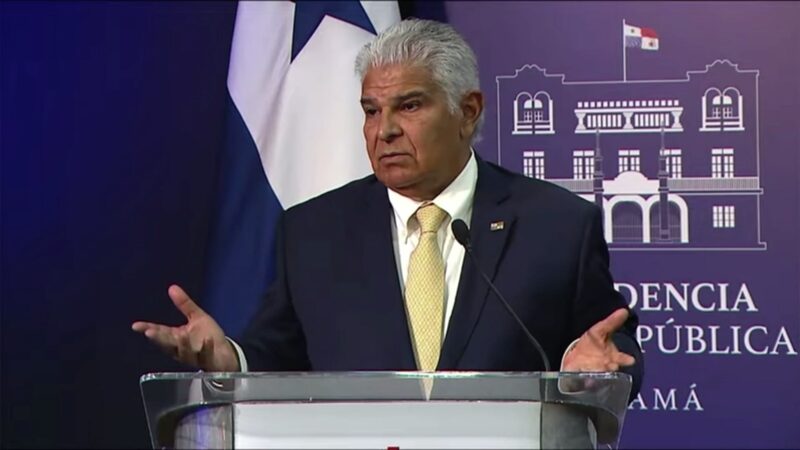

The Panama Canal, often dubbed the 💼 "global shipping superhighway," is back in the spotlight as U.S. and Panama officials discuss a major port ownership shakeup. A Hong Kong-based conglomerate has agreed to sell its stakes in two key Panama ports to U.S. and Swiss investors, sparking debates over trade security and geopolitical influence.

⚓️ This move comes after U.S. President Trump previously criticized the ports’ operations, calling them a potential risk to regional security. Though the exact financial details remain under wraps, analysts say the deal could reshape supply chains for everything from 🛍️ consumer goods to 🛢️ energy shipments passing through the Canal.

🔍 Why does this matter for you? The Panama Canal handles nearly 6% of global maritime trade – think iPhones, electric cars, and even your next Amazon delivery. Any shift in its operations could ripple through prices and shipping times worldwide. Meanwhile, the U.S.’s growing stake highlights its strategic focus on strengthening alliances in Latin America, while Switzerland’s involvement adds a wildcard to the mix.

🌐 For young professionals and travelers: Keep an eye on how this plays out. New port investments could mean upgraded infrastructure, more tourism opportunities, or even fresh internship spots in logistics hubs. Students, add this to your case-study watchlist – it’s real-world geopolitics meets TikTok-era globalization!

Reference(s):

cgtn.com