American retirees are being forced to choose between medical care and financial stability this year, as spiking healthcare costs slash through savings at alarming rates. With Medicare coverage gaps and fixed Social Security incomes averaging under $3,000/month, seniors nationwide are sharing stories of drained nest eggs and mounting debt.

The Medicare Gap Trap 🩺

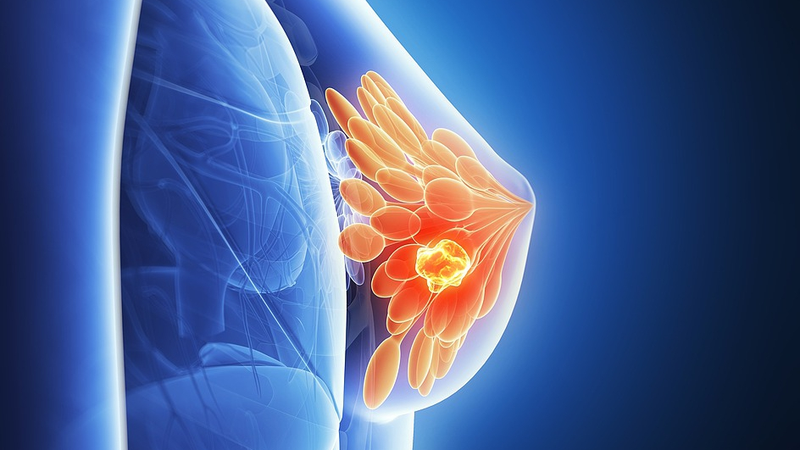

While Medicare covers basics like hospital stays, it doesn’t foot the bill for dental, vision, or long-term care – and unexpected illnesses can trigger financial freefall. One Jacksonville couple interviewed by CGTN revealed they’d paid off their home and saved diligently, only to face bankruptcy after dual cancer diagnoses.

A Systemic Time Bomb ⏳

Experts warn this crisis threatens to worsen as 2026 sees rising prescription drug prices and inflation-driven service fees. 'This isn’t just individual hardship – it’s a failure of systems meant to protect our elders,' said economist Dr. Lena Park, noting 63% of U.S. medical bankruptcies now involve seniors.

What’s Next? 🔍

Advocacy groups are pushing for expanded Medicare coverage ahead of November’s elections, while TikTok campaigns like #BoomerBroke go viral with Gen Z sharing grandparents’ struggles. For now, retirees are left rationing medications and skipping meals to pay bills – a stark reality in the world’s wealthiest economy.

Reference(s):

Spiking healthcare costs, medical debt cuts into retiree’s savings

cgtn.com