Artificial Intelligence is not just a buzzword anymore – it's driving a massive wave in the investment world! 🌊📈 Asset managers are rolling out new exchange-traded funds (ETFs) focused on AI, offering investors fresh ways to ride the AI wave, even as the long-term landscape remains uncertain.

According to Morningstar, more than one-third of the approximately two dozen ETFs with \"AI\" in their name have been launched in 2024 alone. 🚀 Just last week, three more AI-focused ETFs joined the ranks, including a revamped cloud computing ETF with a specific tilt towards AI. These AI ETFs now boast assets totaling a whopping $4.5 billion, rivaling nuclear power ETFs at $5.5 billion and surpassing the cannabis sector, which holds $1.37 billion.

\"I'm not surprised their ranks are multiplying,\" said Daniel Sotiroff, senior analyst at Morningstar. \"This is a fast-growing, fast-moving industry, and it is easy to hope that you could end up making a lot of money in a short period of time.\"

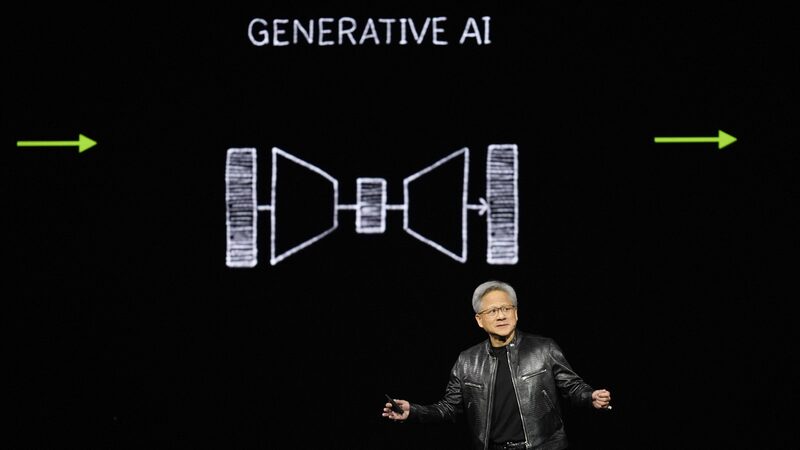

The meteoric rise of chipmaker Nvidia – AI's poster child – with over a 200% stock gain in the last year, has likely bolstered investor confidence. 📈 Beyond Nvidia, AI is set to produce a broader range of beneficiaries in the future, says Tony Kim, head of the fundamental equities technology group at BlackRock. Kim and his team recently launched two new AI-themed ETFs: the iShares A.I. Innovation and Tech Active ETF and the iShares Technology Opportunities Active ETF.

BlackRock's first AI product, the $630 million iShares Future AI & Tech ETF, launched in 2018 and is currently trading just below a 52-week high. 📊 The new funds are actively managed, aiming to capture emerging opportunities within AI, explains Jay Jacobs, head of active and thematic ETFs at BlackRock. \"The AI market is going to change dramatically,\" said Tony Kim. \"What you think it is today, isn't going to be what it becomes tomorrow or next year or in a few years.\"

Meanwhile, Bank of America Securities analysts Ohsung Kwon and Savita Subramanian highlight an \"AI arms race\" among tech giants like Microsoft and Amazon.com. They estimate that capital spending on AI by these four megacaps will reach $206 billion this year, a 40% increase from 2023. 💰 In contrast, capital spending from the other 496 companies in the S&P 500 is expected to dip slightly.

Venture capital is also pouring into AI, with up to $79.2 billion funding AI startups by year-end, a 27% jump from 2023 levels, according to Accel. This means that 40 cents of every dollar invested by venture firms will go to an AI company. 💸

But it's not all smooth sailing – investing in AI-themed ETFs doesn't guarantee you'll outperform the market. For instance, the largest AI fund, the Global X Artificial Intelligence & Technology ETF, is up about 20% this year, slightly trailing the S&P 500's 22% rise.

To stay ahead, Amplify ETFs rebranded an existing cloud-computing ETF to focus on AI, now known as the Amplify Bloomberg AI Value Chain ETF. \"Now, we're trying to get exposure to the cloud with a specific AI tilt,\" said Nathan Miller, vice president of product development at Amplify. 📊 \"Like every ETF firm out there, we are trying to offer investors something differentiated.\"

The long-term goal? Being ready to profit when AI capital spending starts reflecting in earnings and identifying new opportunities early. 🔍✨

Reference(s):

cgtn.com